News

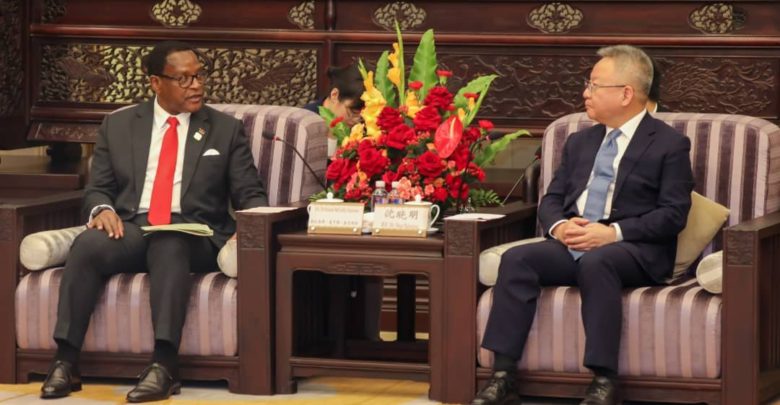

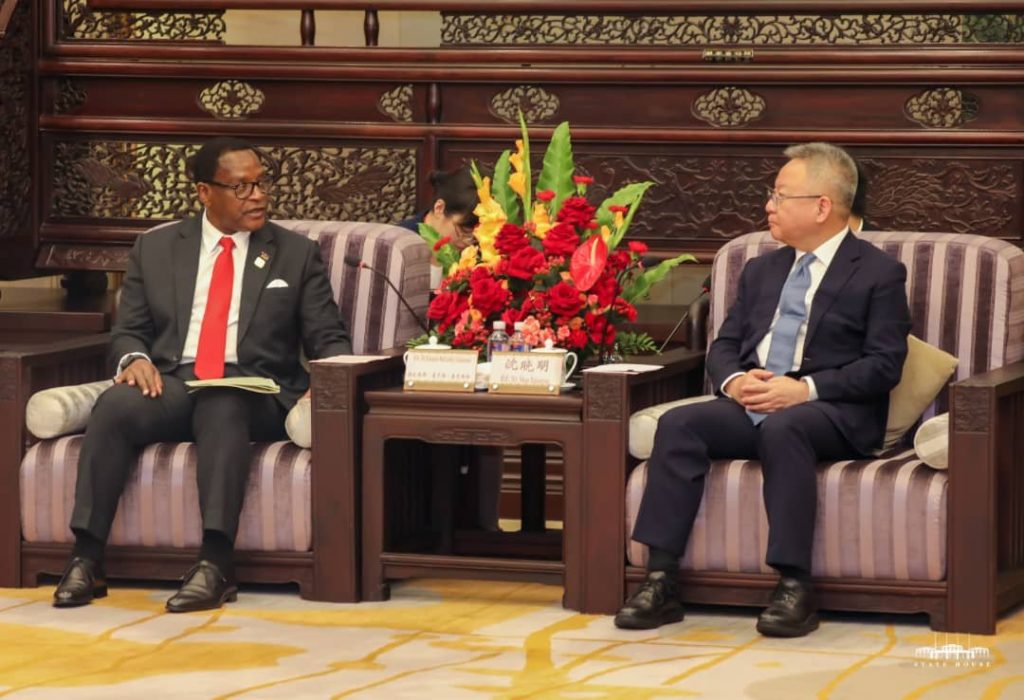

Chakwera visits chinese companies

By Linda Kwanjana

Malawi President has all along stressed the need for Malawi to become an industrialized nation.

Just recently Chakwera said low productivity has become a big enemy for the Country’s economy.

Chakwera while speaking at Kamuzu Palace in Lilongwe during the co-management signing ceremony of Nyika National Park and Vwaza Game Reserve between Peace Parks Foundation (PPF) and Malawi Government which was witnessed by the PPF Vice Chair who is also Mozambique former President Joackim Chisano.

“I have said it before and I will say it again that our primary challenges as an economy is the result of low

productivity and most of the other things people complain about are merely symptoms.”

The historical levels of poverty in this country have persisted because we have not been producing enough goods and services of value to create the wealth, jobs, and food necessary to end poverty, and the little that we do produce was being smuggled out of the country through fraud and with no remittances of revenue to the country,” he said.

With the passion which the President has demonstrated, while in China, Chakwera kicked off his third day in the City of Changsha with a visit of various industrial sites including Sany Group who donated a forklift worth USD 150000 to the Malawi government to facilitate development and industrialization.

The tour will help the President appreciate what is happening in China and replicate here in Malawi.